[vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”center” background_image_as_pattern=”without_pattern” bg_color=”#6e298d” text_color=”light” class=”title-text-row” css=”.vc_custom_1605020501348{padding-top: 50px !important;padding-bottom: 50px !important;background-color: #622d50 !important;}” z_index=””][vc_column][vc_column_text]

BOP NEWSLETTER • Winter 2022

[/vc_column_text][vc_separator type=”small” position=”center” width_in_percentages=”yes” width=”30″ up=”20″ down=”20″ color=”#ffffff”][vc_column_text]

Classifying Workers as Independent Contractors: Watch Out!

by Tim Twigg & Rebecca Boartfield

[/vc_column_text][/vc_column][/vc_row][vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”center” background_image_as_pattern=”without_pattern” z_index=””][vc_column][button target=”_self” hover_type=”default” text=”Featured Article” link=”#top” margin=”10px 10px 10px 10px”][button target=”_self” hover_type=”default” text=”Q&A” link=”#qa” margin=”10px 10px 10px 10px”][button target=”_self” hover_type=”default” text=”Did You Know?” link=”#didyouknow” margin=”10px 10px 10px 10px”][button target=”_self” hover_type=”default” text=”What’s New” link=”#new” margin=”10px 10px 10px 10px”][button target=”_self” hover_type=”default” text=”Tidbit” link=”#tidbits” margin=”10px 10px 10px 10px”][/vc_column][/vc_row][vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image_as_pattern=”without_pattern” row_id=”top” el_id=”top” z_index=””][vc_column][vc_empty_space height=”40px”][vc_column_text]Hiring employees, especially today, can be very time consuming. It can also be very expensive. Financial costs include recruiting, interviewing, payroll taxes, benefits, tools and other resources, etc. These don’t even take into consideration the emotional toll of managing those employee relationships.

Wouldn’t it be better (and less expensive) to bring people on board as a “1099” or independent contractor? This could save an employer a lot of hassle in the long run, so why not?

Sounds simple enough in theory, but if it were that easy, no one would be an employee for any employer – why would anyone bother?

The reason this doesn’t occur is because of federal, state, and sometimes local rules dictating when an employer can classify someone as an independent contractor. And, like it or not, governments ideally want all workers to be employees. As a result, the criteria for determining employee vs. independent contractor status are stacked in favor of workers being employees.

Misunderstandings and misinformation abound on this matter. Using the information below will help you better understand and more successfully navigate the inherent risks.

Let’s start with two simple statements from the Internal Revenue Service (IRS):

- “The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.”

- “You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done). This applies even if you are given freedom of action. What matters is that the employer has the legal right to control the details of how the services are performed.”

Think of hiring a professional to paint your house. You will first search for someone who provides these services. You will meet with them and ask for a bid. If all parties agree on the cost, the professional painter will inform you of when they can paint your house and set a date. After that, it is out of your hands. You will not tell them where to start painting, at what time of day to begin or end, when to apply painters’ tape, when to use a brush versus a sprayer, whether to paint the trim first or last, and so on.

In this case, you direct only the result of the work (paint the house) and not what will be done or how it will be done. This is an independent contractor relationship.

Similarly, classifying someone as an independent contractor is not something you get to arbitrarily decide. To be compliant, you must meet the criteria established within various laws.

Digging a little deeper, the IRS goes on to say, “In determining whether the person providing service is an employee or an independent contractor, all information that provides evidence of the degree of control and independence must be considered.”

The relevant evidence used to specifically determine the “degree of control and independence” are behavioral control, financial control, and type of relationship.

Behavioral Control

Does the company control or have the right to control what the worker does and how the worker does his or her job?

The factors specifically considered under this category include:

- Type of instructions given

- Degree of instruction

- Evaluation systems

- Training

Employees are generally subject to instructions about when, where and how to work. And, if any of these are not done according to an employer’s standards, there are systems in place to evaluate and correct these performance problems. This is not true for independent contractors.

Financial Control

Are the business aspects of the worker’s job controlled by the payer?

The factors specifically considered under this category include:

- Extent to which the worker has incurred un-reimbursed business expenses

- Extent of the worker’s investment

- Extent to which the worker makes his or her services available to the relevant market

- Manner in which the business pays the worker

- Extent to which the worker can realize a profit or incur a loss

Type of Relationship

Are there written contracts or employee-type benefits? Will the relationship continue and is the work performed a key aspect of the business?

The factors specifically considered under this category include:

- Whether a written contract describes the relationship that they intended to create

- Whether the business provides the worker with employee-type benefits, such as insurance, a pension plan, vacation pay or sick pay

- The permanency of the relationship

- The extent to which services performed by the worker are a key aspect of the regular business of the company

If all of this leaves your head spinning and wondering whether or not someone can be legally classified as an independent contractor, the IRS does provide a service for officially determining someone’s status. Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, can be filed directly with the IRS, but it can take up to 6 months to get a response.

For a more detailed review of the IRS criteria and determination service, click here.

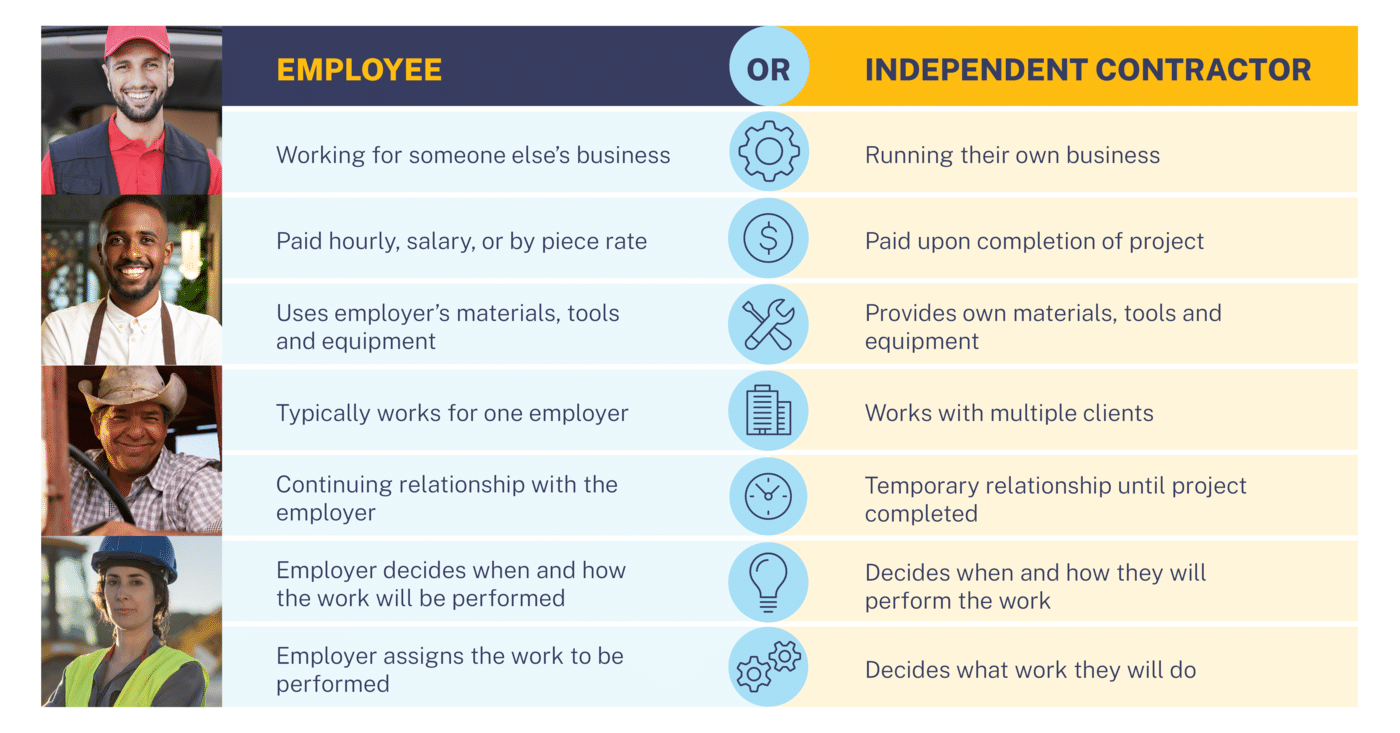

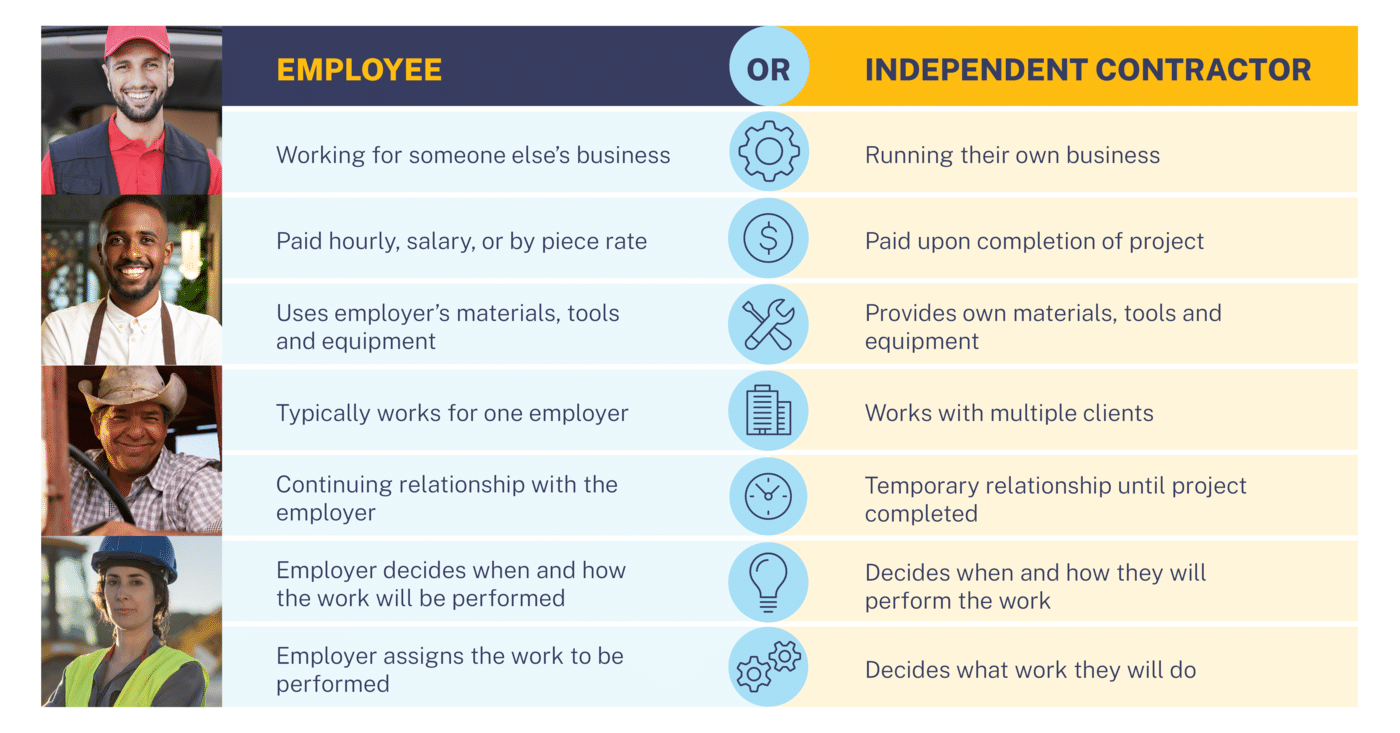

Want an easy-to-read, quick reference guide? Check out the following chart from the federal Department of Labor website:

Keep in mind, the above only covers the federal criteria of independent contractor status. Most states have their own rules that are much stricter, so be sure you look at your state requirements as well. This is not an either/or situation. In other words, compliance only with the IRS will not be enough – employers must comply with all the rules.

In some cases, employers think that if they pay the individual less than $600, they can avoid having to “1099 them” and that solves everything. It doesn’t. It is true that a Form 1099 is not required for independent contractors making less than $600.00 in total, in a year. However, that does not have anything to do with whether or not the person is legally classified as an independent contractor.

What about temporary workers?

When temporary workers are provided through a contractual arrangement with a staffing firm, it is essential that the agreement between the employer and the staffing agency be carefully reviewed to ensure the staffing agency is considered the primary employer. In such a case, you would pay the staffing agency a fee and the staffing agency would pay the employees’ wages and taxes.

While this arrangement means that the worker is not a regular employee of yours, it actually doesn’t mean they are an independent contractor – you just aren’t their primary employer. This individual is jointly employed by you and the staffing agency.

If, however, you are paying the temporary help directly and you only paid the staffing agency a “headhunter’s fee,” then the temporary help must be treated as a regular staff member (i.e., taxes, workers’ compensation, unemployment insurance, etc.). This is true regardless of how long the individual is providing their temporary help.

Penalties for Misclassification

If the IRS determines that an individual has been misclassified, it may levy penalties against the employer, including, but not limited to:

- $50 fine for each Form W-2 the employer failed to file on such employee

- Penalty of up to 3% of the wages

- Up to 40% of the FICA taxes that were not withheld from the employee

- Up to 100% of the matching FICA taxes the employer should have paid.

Penalties can be even greater if the IRS determines the employer willfully misclassified their workers.

The federal department of labor can impose penalties in the form of back wages for up to 3 years, criminal penalties (including possible jail time), penalties for I-9 Form violations, unemployment insurance shortages, workers’ compensation violations, discrimination claims, and more. States may have larger penalties.

In recent publications and announcements, the U.S. Department of Labor (DOL) has asserted that employers are increasingly misclassifying their workers as independent contractors rather than employees. The DOL asserts that most workers are employees for purposes of the Fair Labor Standards Act, and they are combating what they believe to be employers taking advantage of the economic benefits of classifying workers as independent contractors. They have made it clear they are focusing their efforts to crack down on misclassification and hold employers accountable.

Many other states have issued their own warnings about aggressively dealing with misclassification as well.

As a result, now more than ever, misclassification could be a costly mistake as the federal and state governments look to reign in this problem.

Conclusion

Misclassification consequences are no joke and can devastate the unsuspecting employer.

Don’t take decisions about independent contractor status lightly. You must do your due diligence by reviewing the criteria and consulting with professionals, if necessary, before concluding anything. Trust that if the government wanted to make this easy, they would. Know that if classifying someone as an independent contractor was the “get out of jail free card” many think it is, then everyone would be applying it across the board. They’re not, because it’s not.

The simplest solution is classifying any worker that you hire as an employee. Forget independent contractor status! It’s a high bar to meet and costly if you’re wrong. Do you really want to take that unnecessary gamble with your business? [/vc_column_text][vc_empty_space height=”80px”][/vc_column][/vc_row][vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image_as_pattern=”without_pattern” bg_color=”#9a55b9″ text_color=”light” row_id=”qa” el_id=”qa” css=”.vc_custom_1605020359946{background-color: rgba(159,124,145,0.1) !important;*background-color: rgb(159,124,145) !important;}” z_index=””][vc_column][vc_empty_space height=”80px”][vc_single_image image=”2276″ img_size=”500×200″ alignment=”center” qode_css_animation=””][vc_empty_space height=”40px”][/vc_column][vc_column width=”1/6″][/vc_column][vc_column width=”2/3″][vc_column_text]Q: It was recently brought to my attention that an employee made a Tik Tok video in uniform, in the office, during a day I was not present. The language in the background music was vulgar, and it was posted online. The employee who brought it to my attention has asked not to be identified. I am appalled that this was posted. My question is how would you recommend I address this issue? Should I show the employee the video, and give her a written warning? Should I not address it with her directly, and make a general announcement that social media is not to be made or shared in the office? Remind everyone of the social media section in the employee manual?

A: Now that the employee has crossed a line by wearing her uniform and taking the video at work, she needs to be addressed specifically. I recommend bringing her in and confronting the issue. Show her the video, and state clearly that this was a violation of your policy and cannot happen again if she’s to remain working. This should also include a disciplinary write up.

In discussing this with her, be sure you’re clear that it’s about posting content wearing her uniform and doing it at work. What she does in her private life on social media is more-or-less her business, but it becomes your issue and a conflict of interest when it’s done wearing your company’s uniform and using your space. That is not allowed at any time. She needs to keep her personal activities separate from work.

Since I think you can address this employee directly, I don’t think that you also have to remind your team of anything. If you want to do that just to cover the bases, you certainly could. Maybe you do this at your next staff meeting, just as a reminder of the rules.

As for the employee who brought it to your attention, while I think you can keep this secret, I wouldn’t promise that in all situations. Sometimes the only way to confront something is to identify the person who brought it to your attention. Therefore, anonymous complaints are not always acceptable. Sometimes employers have to tell the person something like, “Thank you for the information, but I cannot agree to keeping your name out of this. I will do what I can to protect your name, and I will ensure nothing happens as result of you sharing this information, but I cannot promise your name will be kept confidential. Providing details, including your name, may be the only way to act on this and correct the problem that you’ve brought to my attention.” [/vc_column_text][vc_separator type=”normal” up=”20″ down=”20″][vc_column_text]Q: I had previously offered someone an interview. Due to a conflict, I had to reschedule the interview. Since that time, I have had other, more qualified applicants apply. As a result, I no longer want to interview this candidate. Am I still obligated to go through with the interview?

A: You haven’t mentioned that anything else came up with this individual other than more qualified applicants, which leads me to conclude that you could rescind the offer of an interview. No specific law obligates you to move forward.

Interviews are always at the employer’s discretion. That being said, if a potential candidate can point to something they shared during the process that’s protected under the law, they can allege the interview was rescinded as a result of that information and claim that your actions were discriminatory.

For example, let’s say you schedule an interview. Later, the person calls to reschedule because she has a conflicting appointment with her physician due to being pregnant, which she openly shares with you. She calls later to get rescheduled, and you back out due to other, more qualified applicants coming in. She could allege the change was as a result of her sharing that she’s pregnant and make a discrimination allegation against you. While we know that’s not true, the timing simply doesn’t look good, and it could still result in a legal battle.

Therefore, in a situation such as this, while you can legally back out, it may not be the best choice to make. It may be best to go through with the interview, and later reject the candidate due to someone else being better qualified overall, which you would ideally be able to prove. [/vc_column_text][vc_separator type=”normal” up=”20″ down=”20″][vc_column_text]Q: We have an employee who has long struggled to perform well in her position. We’ve taken several steps to correct this problem: counseling, training, formal write ups, etc. Nothing appears to be working. In some areas, she’s actually getting worse.

Last week, we learned that this employee is using our time and our equipment to look for work elsewhere. While she has not shared anything directly with us, we are under the impression that she’s not happy here and has prepared a letter of resignation. She has not said or provided anything to us.

Rather than await her resignation, or outright terminate her employment, which we are concerned she may perceive as retaliation for applying elsewhere, we would prefer to prepare a document outlining specific and detailed terms under which this employee may remain employed. We would present the document to her for review while under a brief, perhaps two-day, suspension for workplace hostility and attendance deficiencies. Then, either require her signature on the document as a contract for continued employment, or accept her resignation if she will not agree to the written terms of employment.

What do you think of this plan? What’s your advice on the best course of action?

A: Our goal is to always look for the simplest and cleanest path to solving employee issues. Here are some thoughts:

- Creating contracts will supersede your at-will prerogatives. What if you make this agreement with her and decide you don’t want to continue to employ her because her behavior is worse but not related to the agreement you made?

- She is not likely to take this well, thus creating more drama and problems, whether in the meeting or after. She may refuse to sign it or not agree to it and then fight you on the decision to accept that as her resignation. This just has the potential for making things messier unnecessarily.

Here are the options as I see them:

- Wait her out and allow her to voluntarily give you her resignation letter. The gamble with this is that she doesn’t present this to you, and you’re stuck. But, if she does give it to you, then that’s better for you. When she does present the resignation letter, accept the resignation immediately, do not make her work through her notice.

- You can wait her out, get the resignation notice, and let her work through it, per normal procedures.

- Confront her on the issue of applying for work elsewhere while using your equipment and your time and end her employment as a result. Applying for work elsewhere is not protected and would not represent a claim for retaliation.

If you are confident that a letter of resignation is coming, I recommend option 1. If you are not confident that a letter of resignation is coming, then I recommend confronting her about the issue of applying for work elsewhere and end her employment as a result.

While your suggested path is technically legal, it’s not what I’d recommend for you. [/vc_column_text][vc_separator type=”normal” up=”20″ down=”20″][vc_column_text]Q: I wanted to inquire about a salaried employee who utilizes all of their PTO and is now out sick. Is this something that can be adjusted for payroll or do we still need to pay his normal salary? I haven’t had this situation come up so I’m unclear as to what to do.

A: You don’t indicate if this person is exempt or non-exempt, which will make a difference in how this can be managed.

If the individual is non-exempt, then reducing their salary is legally allowable. Once they’re out of PTO, their salary can be adjusted/reduced to reflect any absence that occurs. This is due to the fact that non-exempt employees, even when paid on a salary-basis, must only be compensated for time actually worked.

If the individual is exempt, then reducing their salary is limited/restricted. An exempt employee is one who must meet certain criteria established by the government and, if they do, would receive their set salary regardless of how much or how little they work. Exempt employees are not eligible for overtime pay. These positions are generally reserved for high-level employees.

If they’re classified as exempt, partial day absences could not result in pay deductions, regardless of the reason. Full day absences can be allowable, but it depends on the reason they’re out and what other benefits, such as sick leave or PTO, are available. In general, deductions from pay for exempt employees should be limited in order to avoid liability.[/vc_column_text][/vc_column][vc_column width=”1/6″][/vc_column][vc_column][vc_empty_space height=”80px”][/vc_column][/vc_row][vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image_as_pattern=”without_pattern” row_id=”didyouknow” el_id=”didyouknow” z_index=””][vc_column text_align=”center”][vc_empty_space height=”80px”][vc_single_image image=”2272″ img_size=”550×140″ alignment=”center” qode_css_animation=””][vc_empty_space height=”40px”][/vc_column][vc_column width=”1/6″][/vc_column][vc_column width=”2/3″][vc_empty_space height=”20px”][vc_column_text]

Washington

Expanded Compensable Out-of-Town Travel Time for Employees

[/vc_column_text][vc_column_text]In the court case Port of Tacoma v. Sacks, No. 54498-9-II (Wash. Ct. App. Sept. 21, 2021), the appellate court ruled that travel time for out-of-town travel is considered compensable “hours worked” as a matter of Washington law, regardless of whether any work is performed during the journey, whether the employer owns or controls the employee’s means of transport, or whether the employee’s travel takes place during normal work hours.

The case involved four Washington-based hourly employees who made two trips to China to observe the manufacturing of marine cranes and one trip to Houston to attend relevant training. The Court of Appeals held the employees had to be paid for all of the time they spent traveling to, from, and within China, not just eight hours per day.

Further, the Washington Department of Labor & Industries guidance for its investigators states, in part:

“Washington law is more favorable to employees than federal law…In Washington, all travel time related to work is compensable regardless of the hours when it takes place and includes the time to get to the airport or train station.”

If a person is required to travel to a training seminar in another city, the time from when the employee leaves their home until they arrive at their hotel in the other city is all compensable. Likewise, the time from when the employee leaves the hotel (or training facility) in the remote city, until they arrive back at their home, is also compensable. If, on the other hand, the employee is required to report to work before they travel out of town, then the drive to work and home from work at the end of the travel is considered normal commute time and is not compensable.[/vc_column_text][vc_empty_space height=”20px”][vc_column_text]

Massachusetts

High Court Clarified the 4-Factor Joint Employment Test for Employers

[/vc_column_text][vc_column_text]Joint employment exists when an employee is employed by two (or more) employers in such a way that both (or more) employers are responsible for compliance with various laws like, for example, wage & hour (minimum wage, overtime, etc.), employee leaves of absence, and so on.

This begs the question, when is an employer a joint employer? How is that determined? To read more about joint employment and multi-location businesses, click here to read our article published in Dental Economics and here for our article published in Trojan Today.

In Massachusetts, the Supreme Judicial Court (SJC) has provided much-needed and helpful guidance on the appropriate standard for determining joint employer status. The decision comes from the case Jinks v. Credico (USA) LLC.

In short, the SJC adopted the Fair Labor Standards Act (FLSA) “totality of the circumstances” inquiry. That standard is guided by a “useful framework” of four factors, examining whether the alleged employer:

- had the power to hire and fire the employee;

- supervised and controlled employee work schedules or conditions of employment;

- determined the rate and method of payment; and

- maintained employment records.

The Court noted, however, this is “not a mechanical determination” insofar as these factors “are not etched in stone” and should not be “blindly applied.” Nonetheless, it concluded these factors provide a framework that generally captures “both the nature and structure of the working relationship as well as the putative employer’s control over the economic aspects of the working relationship.”

This is a complicated issue. A careful review of the facts with us or an attorney is advisable before making a decision on joint employment relationships. [/vc_column_text][vc_empty_space height=”20px”][/vc_column][vc_column width=”1/6″][/vc_column][vc_column][vc_empty_space height=”80px”][/vc_column][/vc_row][vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image_as_pattern=”without_pattern” bg_color=”#9a55b9″ text_color=”light” row_id=”new” el_id=”new” css=”.vc_custom_1605020372298{background-color: rgba(159,124,145,0.1) !important;*background-color: rgb(159,124,145) !important;}” z_index=””][vc_column text_align=”center”][vc_empty_space height=”80px”][vc_single_image image=”2278″ img_size=”500×140″ alignment=”center” qode_css_animation=””][vc_empty_space height=”40px”][/vc_column][vc_column width=”1/6″][/vc_column][vc_column width=”2/3″][vc_empty_space height=”20px”][vc_column_text]

New Bill Allows Required Notices and Postings to be Emailed to Employees

[/vc_column_text][vc_column_text]As of January 1, 2022, employers will have an easier time providing the required notices and posters to their remote workers.

Back in July 2021, Governor Newsom signed Senate Bill 657 (SB 657) to make a small change assisting employers with remote workers. SB 657 allows that in any instance in which an employer is required to physically post information, an employer may also distribute that information to employees by email with the document or documents attached.

This does not remove an employer’s obligation to physically display postings as required. It is intended only to clarify the employer’s ability to communicate required information more easily to remote workers.[/vc_column_text][vc_empty_space height=”20px”][vc_column_text]

[/vc_column_text][vc_column_text]A new Virginia law, HB 2161, expanded the state’s prohibitions on discrimination in residential real estate transactions and in employment against military members.

HB 2161 adds “military status” to the list of protected classes of individuals under the Virginia Human Rights Act (VHRA), as well as to the list of classes protected under the Virginia Fair Housing Law. Previously, these statutes protected only individuals who served in the military on the basis of their “status as a veteran.” The term “military status” is more expansive, protecting a larger class of individuals from discrimination in both housing and employment.

“Military status” includes:

- Members of the armed forces (Army, Navy, Air Force, Marine Corps, Space Force, and Coast Guard);

- Members of the Reserves;

- The commissioned corps of the National Oceanic and Atmospheric Administration;

- The commissioned corps of the Public Health Service;

- Veterans of the active military, naval, air, or space service who were discharged under conditions other than dishonorable; and

- A servicemember’s dependents, such as the servicemember’s spouse and children.

All employers in the Commonwealth should be mindful of the expanded protections afforded military status individuals under the VHRA. [/vc_column_text][vc_empty_space height=”20px”][/vc_column][vc_column width=”1/6″][/vc_column][vc_column][vc_empty_space height=”80px”][/vc_column][/vc_row][vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image_as_pattern=”without_pattern” row_id=”tidbits” el_id=”tidbits” z_index=””][vc_column][vc_empty_space height=”80px”][vc_single_image image=”2273″ img_size=”500×140″ alignment=”center” qode_css_animation=””][vc_empty_space height=”40px”][/vc_column][vc_column width=”1/6″][/vc_column][vc_column width=”2/3″][vc_column_text]

Court Says Employers May Require an Unpaid Meal Period During Travel Time

In this case (Dean v. Akal Security Corp., 5th Cir., No. 20-30306, June 22, 2021), the employer hired security officers to accompany and be responsible for deportees on flights carrying them to another country. The security officers were nonexempt, hourly employees for purposes of the Fair Labor Standards Act (FLSA).

The employer had a meal-period policy for the return portion of the flight. The policy required the security officers to take a one-hour, unpaid meal period on any return flight that exceeded 90 minutes and did not have any deportees on board. During the meal period, the security officers were expected to fully disengage from work duties and were permitted to use the time as they wished.

The security officers sued, arguing the meal times were compensable time and did not qualify as bona fide meal periods.

The trial court ruled for the employer, and the 5th Circuit affirmed it was permissible to require an unpaid meal period during otherwise compensable travel time. It was concluded that the regulations and case law on travel time do not bar an employer from requiring an unpaid meal period on airplane flights.

As a result, an employer may require a nonexempt, hourly employee to take an unpaid meal period while engaged in travel time, so long as certain conditions are met. The meal period is not considered work time or compensable travel time if the employee is both relieved from performing any duties during that time and the time otherwise qualifies as a bona fide meal period under the FLSA.

Massachusetts Employer Punished for Failing to Provide Complete and Timely Response to a Former Employee’s Request for Her Personnel File

Massachusetts law, M.G.L. c. 149, § 52C, includes waivers (like an employee’s arbitration agreement) in the definition of a “personnel record.” In Hernandez v. Universal Protection Services, the employer failed to include a copy of the employee’s signed arbitration agreement in its response to her request for her personnel file. Based on this failure, along with the employer’s eleven-month delay in first requesting arbitration, Massachusetts Superior Court Judge Shannon Frison held that the employer had waived its right to compel the employee to pursue her claims only in arbitration.

This decision highlights the critical importance to employers of providing a complete and timely response to a former employee’s request for their personnel file.

A court may be reluctant to limit an employee to arbitration, even in the face of a validly executed arbitration agreement. As such, an employer who wants to enforce an arbitration agreement should take special care not to unwittingly create any additional equitable defenses to such an agreement. To the contrary, if an arbitration agreement exists, the employer should identify and assert it at the first opportunity, to avoid any possible claim of waiver.[/vc_column_text][/vc_column][vc_column width=”1/6″][/vc_column][vc_column][vc_empty_space height=”80px”][/vc_column][/vc_row]